Posted: April 9, 2024

As tax day approaches, it’s important to understand the different tax brackets and what that means for you. Your tax rate is determined by your taxable income and filing status, which will drop you into one of seven tax brackets for 2023. Each bracket is assigned a corresponding tax rate; the highest rate, called a marginal rate, only applies to a portion of your income (more on that later). This system means that people with higher incomes pay higher federal taxes, and vice versa.

Federal rates will remain the same until 2025, thanks to the Tax Cuts and Jobs Act of 2017; however, the IRS may adjust thresholds for inflation.

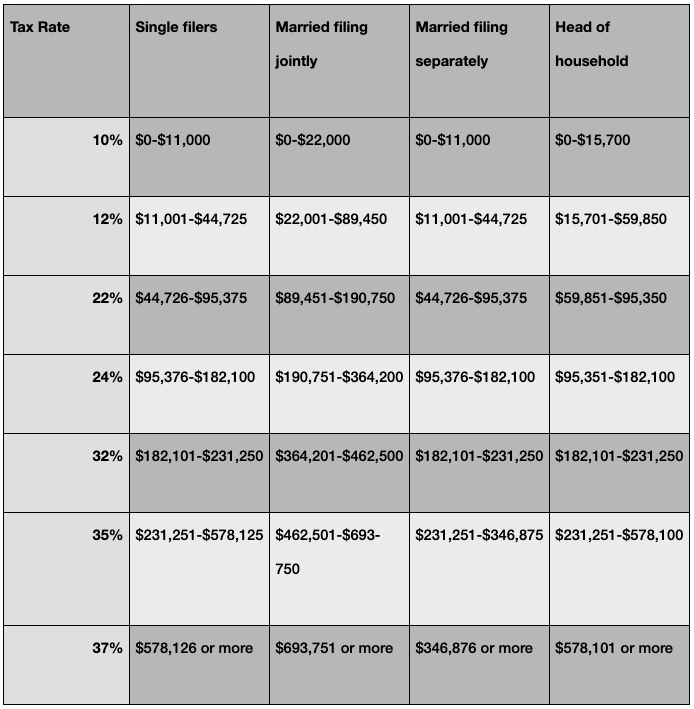

2023 Tax Brackets

There are four main filing statuses when it comes to taxes:

- Single filers

- Married filing jointly

- Married filing separately

- Head of household

Your income based on these filing statuses will determine your overall tax rate for the year.

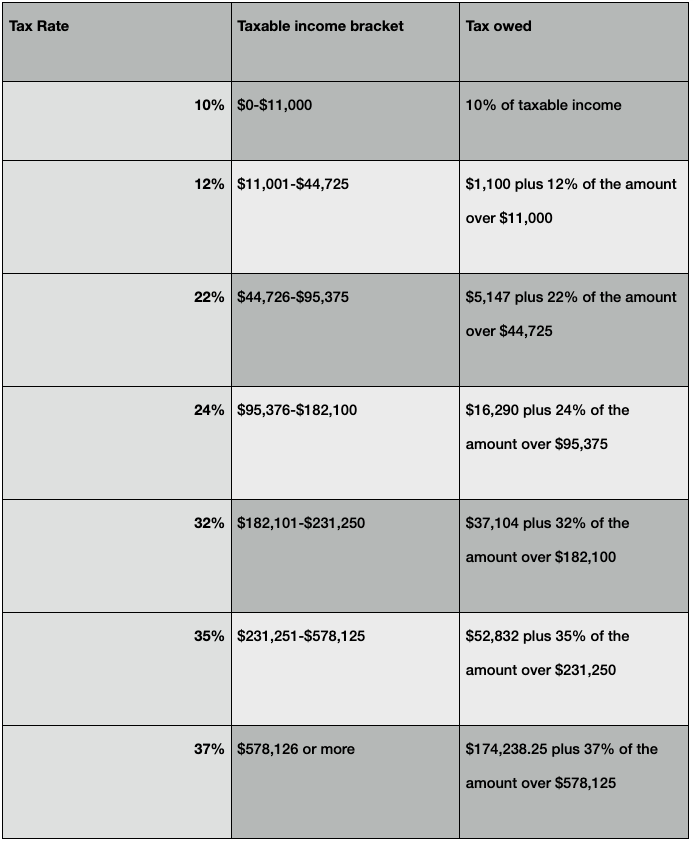

For example, a single filer who made $50,000 in 2023 is in the 22% tax bracket. However, to complicate (but improve!) matters, this person won’t pay 22% on their entire income. Instead, their tax breakdown will look like this:

- $0-$11,000 of their income is taxed at 10% (approx. $1,100)

- $11,001-$44,725 of their income is taxed at 12% (approx. $4,047)

- $44,726-$50,000 of their income - only $5,274 - is taxed at 22% (approx. $1,160; this is the marginal rate)

That adds up to a tax bill of $6,300 ($5,147 plus 22% of the amount over $44,725), or 13% of this person’s taxable income - even though they are technically in the 22% bracket.

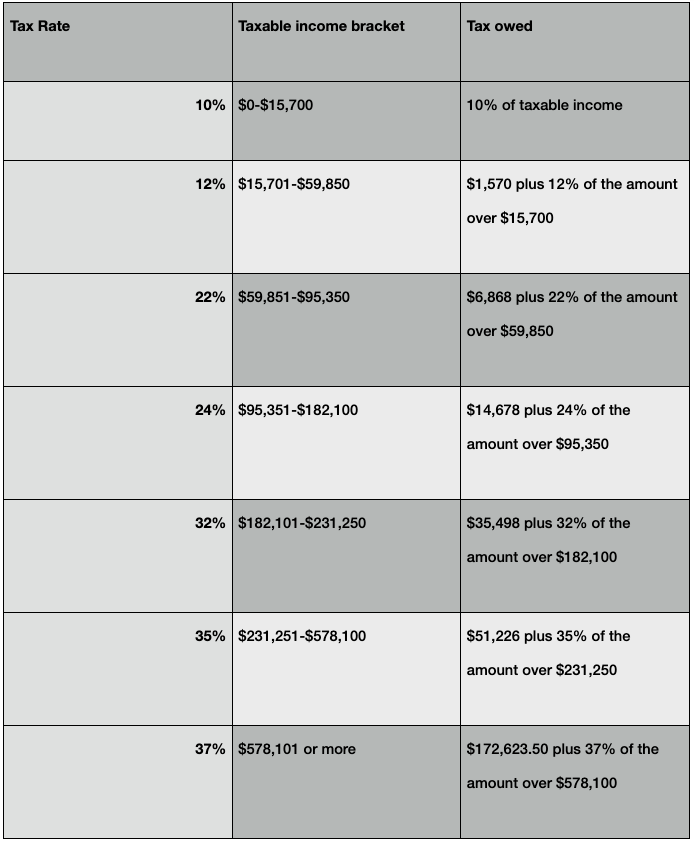

So, what is that 13%? The 13% is called an effective tax rate, which is the percentage of taxable income that you actually pay in taxes. To calculate this more easily, divide your total tax owed (line 16) by your total taxable income (line 15) on your Form 1040. The charts below can help give you an idea of what you owe.

Single filers

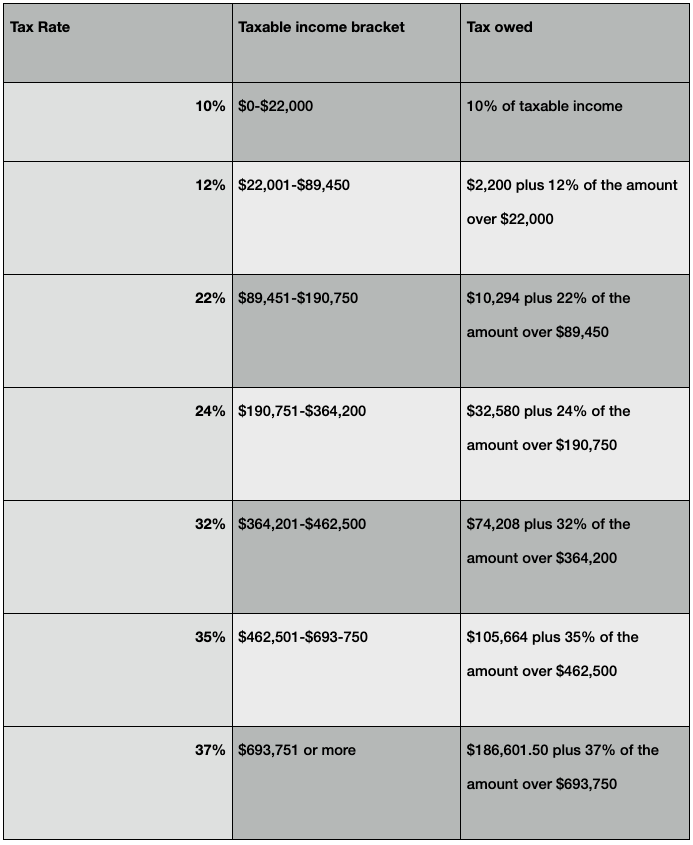

Married filing jointly

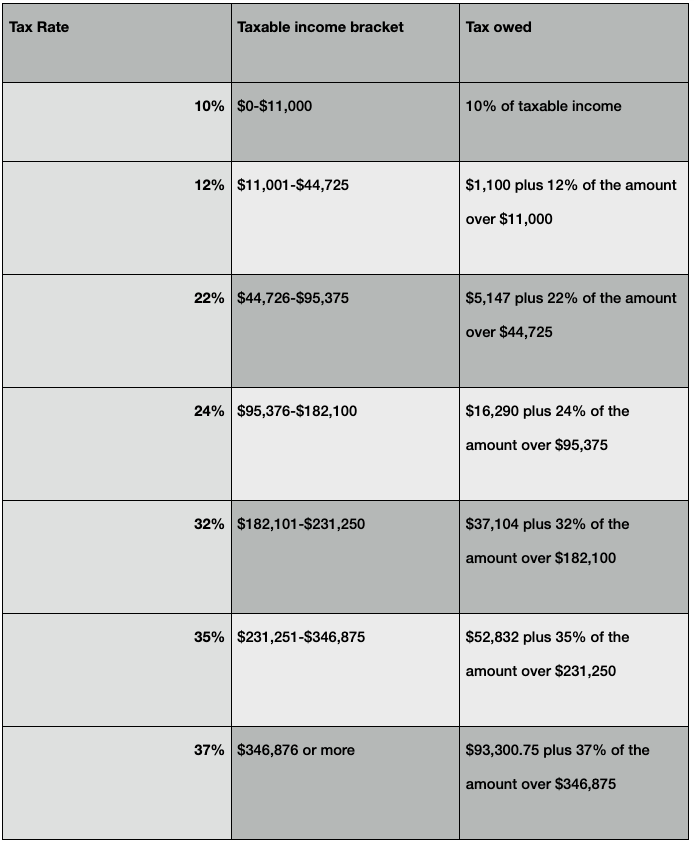

Married filing separately

Head of household

Reducing taxes owed

Finally, there are two ways to reduce your tax bill: credits and reductions. Credits reduce your bill on a dollar-for dollar basis and don’t affect your tax bracket. Deductions reduce how much of your income is subject to taxes. Check out our Delving into Tax Deductions blog for more info!

You May Also Like

Finance

Changes to 401(k)s and Roth IRAs in 2025

Posted: December 20, 2024 Saving for Retirement: What You Need to Know for 2025 The new...

Finance

Is it Worth Refinancing a Home Loan?

Posted: December 10, 2024 Unlocking Savings: Is it worth refinancing a home loan? With...

Finance

How to Maximize Your FSA & HSA

Posted: November 1, 2024 Maximizing Your FSA and HSA: A Guide to Smart...