Categories

all

Community

Posted: February 28, 2025

Quality Tank Solutions expands with hands-on support from WaterStone Bank

Jimmi-Jean Sukys never set out to dominate the steel tank business—nor did she dwell on the rarity of being a woman in a male-dominated field. Yet today, Sukys, as CEO of Quality Tank Solutions (QTS) and a new member of the Women's Business Network and Advisory Council, is a recognized leader in the Midwest’s steel tank sector. A key partner in this journey has been WaterStone Bank, particularly Business Banker Jim Crowley. Sukys highlights their 12-year-long working relationship, crediting the bank with facilitating QTS's rapid growth. "Getting the right bank is super important, and I had to learn that," she reflects. "Jim has been there since the beginning, and WaterStone has been a big part of our growth.”

Sukys’s journey began in manufacturing sales, where each step deepened her interest in tank design, engineering, and production. Immersing herself in the process, she developed not only expertise, but also a passion for the craft and the tight-knit community she found. "It's the people I fell in love with," Sukys explains. "You get into something, whether it's hockey or sailing, and those people become your family. The people in this industry—my peers, and even my competitors—became mentors and friends."

Under Sukys’s leadership, QTS has grown into a premier designer and manufacturer of stainless steel tanks for a wide range of industries, including brewing, dairy, pharmaceutical and pet food. While the company initially thrived during the microbrewing boom, Sukys’s diverse background in food and beverage and pharmaceutical manufacturing allowed her to pivot as market demands shifted. She expanded QTS's capabilities to serve emerging sectors, such as non-alcoholic beverages, and invested in facilities that could handle the production of larger tanks. Throughout the expansion, says Sukys, “Jim and WaterStone Bank have been there to support us, making sure we had what we needed to take the next step.”

For Sukys, earning a spot on the Women's Business Network and Advisory Council isn’t just an honor—it’s a tool to keep pushing QTS forward. "It gives me an edge," she says. "If I can bring in more business, that means more opportunities for my employees."

Sukys’s strategic investment in some of the only facilities capable of producing super-large tanks is paying off. Now, with her focus on scaling up—finding ways to speed up production without compromising quality—the company’s relationship with WaterStone Bank will continue to be key. “WaterStone has helped us take smart risks,” says Sukys. “All along the way, they have backed us in letting us prove what can be done."

5 minutes read

5 minutes read

Finance

Posted: December 20, 2024

Saving for Retirement: What You Need to Know for 2025

The new year is nearly here, which means it’s time to start thinking about year-end IRA contributions and changes for 2025. Individual retirement accounts (IRAs) and 401(k) accounts are your best friends when it comes to saving for retirement, so it’s important to stay on top of changes that affect the way you save.

Year-End reminders

The deadline to contribute to a 401(k) is December 31, 2024. You can continue to make 2024 contributions to Roth and traditional IRAs until April 15, 2025. If you exceed your contribution limit ($7,000 for people under age 50 and $8,000 for people age 50 and older), you can withdraw excess funds by April 15, 2025. If you fail to do this, you will incur a 6% tax each year on the excess amount in your IRA.

People aged 73 and older must take a required minimum distribution (RMD) on retirement savings accounts each year. If you fail to take your RMD for 2024, you will face an excise tax. Remember that the RMD must be calculated separately for each account.

5 Changes to 401(k)s for 2025

Important changes are coming for 2025 that affect your retirement accounts. Here’s what to look out for.

- Catch-up contributions

Catch-up 401(k) contributions for people over age 50 allow them to make additional deposits into retirement savings accounts. Beginning in 2025, the catch-up amount increases to $7,500, making the yearly contribution limit $30,500. Taxpayers will also be able to contribute $23,500 to their 401(k), up from $23,000 in 2024. In 2025, people aged 60-63 can contribute a max catch-up amount of $11,250, bringing their total limit for 401(k) contributions to $34,750. - 401(k) auto-enrollment

In 2025, taxpayers will be auto-enrolled into a 401(k) plan that must be at least 3% but no more than 10% of their income. Each year, the contribution amount will increase by 1% until it reaches 10%, but not more than 15%. However, just because taxpayers will be auto-enrolled does not mean participation is mandatory. Employees can change their rate or opt out by selecting 0%. - SIMPLE IRA contributions

SIMPLE IRAs previously had a limit contribution amount of $16,000 per year, and individuals 50 and older could make an additional catch-up contribution of $3,500. In 2025, that contribution limit increases by $500. New catch-up contributions for individuals aged 60-63 will increase to $5,000. - Inherited IRAs

Changes to inherited IRAs are coming as well. Suppose you inherited an IRA from someone who died on or after January 1, 2020. In that case, you are required to withdraw all funds from that IRA no later than December 31 of the 10th calendar year following that individual’s death (e.g., for someone who died in 2020, you would be required to withdraw the money by 2030). There are a few exceptions of people who can benefit from a “stretch IRA” strategy, including:- Surviving spouses

- A child of the decedent under age 21

- A beneficiary not more than 10 years younger than the decedent

- An individual who is disabled or chronically ill

People in the categories above must still withdraw funds from the IRA over their lifetimes beginning in the year following the decedent's death. Surviving spouses may also transfer the funds to their own IRA, and are not required to withdraw funds until they reach their required beginning date. - Required minimum distribution penalties

Beginning in 2025, people who do not take the required minimum distribution from their IRA accounts will incur a 25% penalty.

Find the Right Plan

A secure retirement is one of the best gifts you can give yourself—contact us at (414) 761-1000 or visit any WaterStone Bank location for help selecting the account that suits you!

5 minutes read

5 minutes read

Finance

Posted: December 10, 2024

Unlocking Savings: Is it worth refinancing a home loan?

With mortgage interest rates budging only slightly from recent highs in 2023, many homeowners are faced with a decision: Act now to take advantage of the downward increment or hope for additional drops in the upcoming months. Consider some of the following factors to help you calculate whether a refinance is the best move when interest rates are bumpy.

4 Advantages of Refinancing a Home Loan

- Lower monthly payments are one of the main reasons that homeowners choose to refinance. A reduced interest rate can lead to decreased monthly payments, easing your financial burden. Additionally, a lower interest rate can lead to substantial savings over the life of a loan, potentially putting you thousands of dollars ahead.

- Refinancing during a period of declining rates may also shorten your loan term. For instance, you could refinance from a 30-year to a 15-year mortgage without significantly increasing your monthly payments, allowing you to pay off your mortgage faster.

- If you have significant home equity, a cash-out refinance might be an option. This allows you to access funds for home improvements, debt consolidation, or other financial needs, often at a lower interest rate.

- Refinancing can also enable you to switch loan types, for example from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage, providing more predictable payments and greater financial stability.

4 Factors to Watch Out For

Before deciding to refinance, it is important to consider the following factors.

- Closing costs, which typically can range from 2-5% of the loan amount, should be weighed against the savings from a lower rate to ensure the savings outweigh these costs.

- Calculating the break-even point—how long it will take for the savings to cover the refinancing costs—is essential. If you plan to move or sell your home before reaching this point, refinancing might not be advantageous.

- Your credit score also plays a role in refinancing. A higher credit score can help you qualify for better rates, so check your credit score and work on improving it if needed before applying.

- Finally, carefully review the terms of the new loan, including any prepayment penalties or changes to the loan duration, to ensure they align with your financial goals. Consider broader economic conditions—in this case, the possibility that interest rates will continue their downward movement—and your personal long-term financial outlook. Even if rates are lower now, ensure that refinancing fits into your overall financial strategy.

By weighing these factors, you’re in a better position to make an informed decision about whether refinancing your mortgage is the right move when interest rates fall. For more information on what a refinance might look like for you, contact our Residential Mortgage Loan Officer Peter Salamone.

3 minutes read

3 minutes read

Finance

Posted: November 1, 2024

Maximizing Your FSA and HSA: A Guide to Smart Healthcare Planning

Understanding HSAs and FSAs

Flexible spending accounts (FSAs) and health savings accounts (HSAs) are valuable tools in benefits packages, allowing you to set aside pre-tax funds for health-related expenses, including prescriptions, doctor visits and more. Contribution limits differ, so it’s a smart move to consult a tax professional before opening an account. Many accounts include debit cards for easy access to funds, but if yours doesn’t, be sure to keep receipts to submit for reimbursement.

What is the difference between an HSA and FSA?

FSAs and HSAs have some important differences. FSAs typically have a “use-it-or-lose-it” rule, requiring you to spend the funds by the end of the year. They’re also tied to your job, meaning if you leave or lose your job, your funds expire with your employment termination date.

In contrast, HSA funds accrue, rolling over from year to year, and remain available even if you change jobs. HSAs are tied to high-deductible health plans, but the money remains yours to use whenever needed, even if your employment status changes.

HSA- and FSA-eligible items

HSA and FSA funds can be used for obvious health-related expenses such as prescription medication and hospital bills. But they can also be used for other qualified medical expenses. The following items and services are usually eligible for payment with your FSA and HSA funds, but be sure to check your individual plan:

- Over-the-counter medication and menstrual products

- Telemedicine visits

- Maternity supplies, such as breast pumps

- Sunscreen (must be SPF 15 or higher)

- Transportation and travel for medical care

- Weight-loss programs

- Medically related home improvements (for example entrance ramps and handrails)

What isn’t covered? HSAs and FSAs don’t cover things like cosmetic procedures, monthly health insurance premiums or gym memberships.

Getting the most out of your FSA account

Now is the time to think about spending the funds left in your FSA and how you’re going to spend them by the end of the year. Do you have any outstanding medical bills, or doctor appointments you can schedule for the next few months? One thing to steer clear of is stockpiling—the IRS tends to frown on stocking up on two years’ worth of contact lens solution and ibuprofen.

Getting the most out of your HSA account

Because funds in HSAs roll over from year to year, there’s no immediate need to spend the money in your account. Think about expenses you and your family may incur soon—vaccinations, dental visits, and new glasses. With a WaterStone Bank HSA, your money earns interest, and you can even invest a portion to grow your savings over time.

To learn more about the advantages of HSAs, find a WaterStone Bank branch near you or contact us for more information.

5 minutes read

5 minutes read

Community

Posted: September 24, 2024

As summer winds down and the busy school year approaches, it’s even more important to examine your budget and note where you can save—particularly on groceries, which only seem to increase in price. Eating at home is still the best way to save money on food, but what are some other grocery shopping tips to save money this fall?

- Make a list and check it twice

Before heading off to the grocery store, inventory what you have on hand in your refrigerator and pantry, which will help prevent purchasing items you already have. (Four jars of salsa anyone?) Then, write down what you still need from the store and—this is the most important part—stick to your list. Avoiding impulse purchases will help you save, and every little bit counts. - Plan your meals

Once a week, sit down and plan your upcoming meals. What will the kids need for school lunches? Will you have any leftovers that you can eat for lunch during the workday? Do your recipes have any ingredients in common that you can buy together and use up during the week? Planning your meals means buying fewer ingredients, which not only saves money, but reduces food waste. - Price check to save

One of the easiest ways to maximize your grocery budget is by comparing prices. Check prices at different grocery stores, as well as between name-brand and generic items. While we can’t deny that the name-brand versions of some products are worth the cost, many generics offer the same quality at a lower cost, making it a smart swap for your budget. - Clip coupons

These days, most people get their news online. But if there’s one thing the Sunday newspaper is still good for, it’s coupons. Clip coupons for the items you think you might need that week and take them with you when you shop. Remember, it’s still important to compare prices; a name-brand item with a coupon might still be more expensive than a generic item. And a buy-one-get-one offer might seem like a good deal, but will you use double the amount of a particular item? If buying a newspaper isn’t your thing, that’s OK—some manufacturers send coupons in the mail and grocery stores often have digital versions on their websites. - Online shopping

Most grocery stores offer consumers the option to buy their groceries online and pick them up in the store. This can have its pros and cons; you may not find the size you’re looking for online, and opt to buy a larger product for more money. But it can also help you stick to your list. Add all of your items to your cart and check the total; then, decide which items you actually need, and which were “nice-to-haves.” It’s much easier than getting up to the checkout and being surprised by the total. - Figure out your "burn rate"

Your “burn rate” is the rate at which you use up products. If you can figure out how often you go through a particular item, you can start to plan when you will need to purchase that in the future. - Stock up

It’s tough to stock up on perishables, but all is fair in pantry and freezer items. Try not to go overboard, but if there’s a buy-one-get-one-free sale on your favorite shampoo, take advantage. After all, you’ll use it eventually, and it helps to save you a few bucks. Stocking up can save money if you do it right. - Unlock savings with credit card and store rewards

Look at what your credit card offers and see where you might benefit: Explore WaterStone Bank credit cards that offer rewards or cash-back programs when you use your card to shop for groceries. Some grocery stores also have their own rewards programs and offer money off on gasoline. Do your homework and start saving! - Mix and match for maximum savings

It’s convenient to do all your shopping at one store, but if you can, consider shopping at a few different places. Stock up on basics and pantry items at bargain stores, take advantage of the weekly sales at your local supermarket, and reserve the upscale market for your favorite specialty items. If you have the time and you’re willing to make a few extra stops, your wallet will thank you. - Invest in a wholesale membership

It’s no surprise that wholesalers like Costco and Sam’s Club offer items in bulk for lower prices. This is particularly appealing for families, who go through items more quickly than singles and couples. If you have the room to store extra items, it may be worth it to sign up for a membership. You might pay a little bit more for a large quantity of toilet paper at Costco than you would at Target, but it’ll last longer and you won’t have to re-purchase it as often, saving you money in the long run. - Shop on sale

Check your mail for grocery store fliers and figure out what’s on sale that particular week. Just remember to check expiration dates, especially on things like meat, seafood, dairy and eggs. It’s also smart to keep an eye on sale cycles. For example, you’ll get a great deal on candy the week after Halloween. Take advantage of the clearance sales and stock up on items you can use later.

Happy shopping!

5 minutes read

5 minutes read

Finance

Posted: August,21, 2024

Living with debt can feel like an ongoing worry, affecting both your monetary and mental health. The good news is that financial freedom is possible with the right strategies and perseverance. Read on for our practical steps and top tips to help you achieve financial independence, get out of debt, and take charge of your future.

- Pay more than the minimum

The quickest way to make a dent in your debt is to pay more than the minimum amount every month—which will also cut down on the amount you pay in interest. If you can double your minimum payment, that’s great! If you can only afford to chip in an extra $50, that’s OK, too. - Make payments more often

For credit cards especially, try to make more than one payment per month. Not only will this help you keep track of your balance, it will also help you understand your balance/usage ratio, or the percentage of your available balance being used. This is also an important factor used in determining credit scores, so it’s smart to keep track. - Pay your largest debt first

It’s not uncommon to carry debt on a credit card or two, as well as have student or other loans. Your most expensive form of debt is the one with the highest interest rate—usually a credit card. Try to pay these down first to avoid being clobbered by interest rates. Then, move on to the loan with the next-highest interest rate—this is known as the avalanche method. - Pay your smallest balance first

Similar to the avalanche method, the snowball method focuses on paying off your smallest balance first, then applying your efforts toward the next-lowest balance, and so on. This will help you build momentum and feel like you’re making an immediate impact on your debt. - Use tools at your disposal

Take advantage of things like automatic bill pay, online payments and payment reminders to help keep you on track. Check your balance regularly so you know exactly what’s coming in and what's going out. - Refinance your loan

In some cases, you may be able to refinance and shorten the term of your loan. Your monthly payments will likely increase, but you will also pay off your debt faster. Depending on the type of the loan, you may also qualify for a lower interest rate or longer loan term. - Consolidate debt

Loan consolidation involves combining several high-interest loans or credit card balances into one new loan with—fingers crossed—a lower interest rate. Take advantage of that lower interest rate to pay as much as you can as long as you can, because sometimes those rates increase after a set period.

Have questions or need additional help? Contact WaterStone Bank to learn more.

5 minutes read

5 minutes read

Finance

Posted: July 22, 2024

At the peak of the “great resignation” in 2022, 3% of American workers—roughly 4.5 million people—were quitting their jobs each month. This trend in the job market has continued, with a recent survey showing that more than half of workers in the U.S. are considering switching jobs within the year.

Changing jobs or starting a new career often means starting at the bottom with a lower salary or adjusting to a different benefits package. Whether you’ve chosen to change careers or are dealing with a job loss that you didn’t anticipate, making a plan can help ease the transition. We’ve rounded up our top financial tips for career changes to help you navigate your big life transition.

- Track expenses

Keep track of everything you spend, from monthly bills to dining out. This will help you understand your current spending, what your fixed expenses are and where you can afford to cut back. - Pay down debt

Most people have some type of debt, whether it’s a mortgage, student loans or a credit card balance. The more you can pay down, the better—especially debt with high interest rates, like credit cards. - Save for a rainy day

Giving up a secure job for something new can be risky, especially if you’re taking a pay cut. Before you take the leap, create an emergency fund that covers your minimum expenses for 3-6 months so that you have something to fall back on. - Create a new budget

New careers often require new budgets. If you expect your new job to come with a lower salary, try to scale back on some of your luxuries to help ease the transition. Once you receive your first paycheck, you will have a better idea of your net income, which will inform your new budget. - Don’t touch your retirement funds

It might be tempting to dip into your 401(k) to help tide you over, but do your best to avoid it. Withdrawing funds early often comes with hefty taxes and penalties, not to mention the fact that you’ll have less money when you do retire. Keep contributing to your retirement fund—you’ll be glad you did! - Do the math

Be honest with yourself: Are you willing to take a pay cut? What’s the lowest salary you can reasonably accept and still live comfortably? Are your skills, education and professional experience worth more than that? Or is this your dream job, where taking a huge pay cut doesn’t matter if it means you’ll be achieving a lifelong goal? As the old saying goes, “Know your worth—and then add tax.” - Stay healthy

Every employer is different when it comes to health benefits. Packages differ and plan rates fluctuate; what can you afford with your new salary? Is there a waiting period between starting the new job and your benefits kicking in? Will you need to apply for COBRA coverage to tide you over? Take care of any medical needs like checkups and procedures while you have adequate coverage, and find out if you need to empty your flexible spending account (FSA) before changing jobs. - Ease into things

Not everyone has the luxury of easing into a new career; some people are struggling with layoffs and downsizing. If you can, transition into your new career while in your current position. Take classes, pursue certifications or take on a part-time job in your new planned field. Give yourself time to plan and prepare before you make the change. - Take on a side hustle

Hustle culture is here to stay. Taking on a side gig is a great way to save a little extra money, whether it’s for a vacation or your job-change slush fund. Look for freelance or part-time jobs you can do from home—even better if they’re related to the new career you would like to pursue. - Find your village

They say it takes a village, and it’s the truth. A supportive network of family, friends and professional connections can keep you accountable, help you achieve your goals and support you when you need a kind word. Changing careers or switching jobs can be a challenge, but it’s also exciting—a chance to try something new and pursue your interests.

Need help budgeting and planning for a career change? We’re here to help.

5 minutes read

5 minutes read

Banking

Posted: June 17, 2024

As you step into the exciting world after high school, it’s not just about tossing your cap in the air. It’s also a chance to prepare for newfound responsibilities, like managing your finances. Graduation signals your progress toward financial independence, which is the perfect time to open a student checking account. Read on and learn the benefits of opening a student checking account.

From Summer Jobs to Savings

Whether you spend your summer interning in an office, working part-time at a restaurant, or employing yourself with jobs around your neighborhood, having a job means earning money. But how do you keep track of that money? Instead of stashing cash in your drawer, consider opening a bank account.

Student checking accounts come with convenient features that let you securely deposit checks anytime, anywhere. Being connected to a checking account also allows you to have your paycheck deposited directly into your account, which is a secure way of being paid.

College Bound? Be Bank Smart

Heading off to college is an adventure filled with new experiences and challenges. Along with the excitement, it’s crucial to have easy access to your funds, without the hassle of carrying cash. A student checking account helps you manage bigger payments—like tuition and rent—keeping your funds secure while ensuring your money is just a few clicks away whenever you need it.

Benefits of a Student Checking Account

Did you know that kids who have savings accounts early in life tend to be financially ahead of their peers who don’t? Opening a student checking account isn’t just about convenience—it’s about setting yourself up for success with a secure financial future.

Look for these benefits with a student checking account:

- Mobile Deposit: Say goodbye to long bank lines and hello to convenience. With mobile deposit, you can deposit checks with just a few taps on your smartphone.

- Digital Banking: Manage your finances on the go with 24/7 access to your account via online and mobile banking platforms.

- Free ATM Transactions: Enjoy the flexibility of accessing your money without worrying about ATM fees. The WaterStone Bank Student Checking Account gives you 8 free transactions per statement cycle (statement cycles are typically 30 days, and may not match the calendar month).

- No-Fee Accounts: Keep more of your hard-earned money with a student checking account that doesn’t charge monthly maintenance fees.

- Overdraft Protection: Avoid the embarrassment and inconvenience of overdrafts with built-in protection that helps you manage your spending responsibly.

Graduation is a great time to take stock—getting a new job or heading off to college serve as clear signals that it’s time to take charge of your financial independence! For more information about opening a Student Checking Account at WaterStone Bank, visit wsbonline.com.

3 minutes read

3 minutes read

Finance

Posted: May 31, 2024

When investing, it’s important to assemble a diverse portfolio to help build your wealth. One option to consider is ESG (environmental, social and governance) investing, also called responsible or sustainable investing.

As awareness grows about the long-term effects of pursuing short-term gains, the idea of sustainability in all of its forms—from local production to responsible management of resources—has become increasingly popular. In addition, considering whether companies incorporate ESG criteria and policies that benefit the environment, community, and their employees into their practices, can help you to invest in ways that align with your values.

Evaluate ESG

Examining a company’s ESG factors can provide insight for individual investors, since not all organizations share the same goals. To ensure that a potential company aligns with your values, consider the following:

- Environmental: Assess an organization’s impact on the environment, including carbon footprint, water use, waste and clean technology initiatives.

- Social: Evaluate the company’s positive impact on society and how it advocates for positive change. Look for initiatives involving community involvement; diversity, equity and inclusion (DEI); employee health and safety; and human rights.

- Governance: Consider how an organization is managed in terms of driving positive change. This includes the quality of management and the board, employee compensation, non-retaliation policies, and transparency.

Identifying Responsible Investments

To identify investments with strong ESG factors, you can use the following approaches:

- Research ESG Ratings: Many financial news platforms and research firms provide ESG ratings for stocks based on comprehensive analyses of companies’ ESG practices. You might also choose to research ESG funds through brokerages—just search “ESG.”

- Explore ESG Funds: Some analysts and organizations publish lists of top-rated ESG stocks. You can also search for particular businesses or sectors that come from a portfolio with positive ESG ratings. Researching an individual company can also turn up information on corporate history and practices.

Keeping ESG factors in mind, there are two primary strategies when looking for responsible investment options:

- Activist investing: Invest in an organization with the intent of influencing how the business operates. For example, someone who cares about decreasing carbon emissions may choose to invest in an auto company to push for more eco-conscious practices.

- Impact investing: Invest in organizations that have a direct positive impact on the environment or community. For example, someone who cares about social change might invest in an organization that provides after-school programs to underserved communities.

Leveraging Expert Advice

If ESG factors are important to you, doing some homework before you choose where to invest your money is key. Remember that financial advisors are a great resource for identifying responsible investment targets. They can provide guidance and in-depth information you may not have access to, including how to diversify your portfolio to make the biggest impact.

Still have questions? Contact WaterStone Investment Services for more information.

3 minutes read

3 minutes read

Banking

Posted: May 6, 2024

Setting aside a rainy day fund, also called an emergency or contingency fund, is important for any solid financial plan. Think of this part of your personal budget as a financial umbrella when life hits you with an unexpected downpour, whether it’s a car repair, job loss or medical emergency. Here are some steps to help you set up a fund that can save the day and keep mishaps from derailing your master plan.

- Set a Goal Start by setting a realistic goal for your fund, aiming to save enough to cover at least three to six months’ worth of living expenses. This target can provide a comfy cushion, keeping you from resorting to riskier solutions such as taking on high-interest debt or depleting other savings accounts

- Keep it Separate Open a dedicated savings account just for your fund. Keeping this money apart from your everyday checking account makes it easier to resist the temptation of dipping into these funds for spur-of-the-moment expenditures. Pro tip: Look for an interest-earning savings account to maximize your savings growth over time.

- Create a Budget Develop a detailed monthly budget that outlines your income and expenses. Look for areas where you can cut costs and redirect those savings towards your rainy day fund. Then, make it a habit to set aside a portion of your monthly income to your emergency savings, treating that amount as a non-negotiable expense.

- Set Savings to Autopilot WaterStone Bank’s user-friendly digital banking app makes it easy to transfer money from other accounts to your dedicated rainy day fund savings account. Setting your savings to contribute automatically is a hands-off approach that can help you build your emergency fund faster.

- Review and Adjust Keep an eye on your savings, periodically reassess your goals, and strategically adjust as needed to take into account changes in your income, expenses and long-term financial goals. Track your progress, and help yourself to stay motivated by acknowledging and celebrating milestones along the way.

Setting up and contributing to a rainy day fund is a key step toward financial security and peace of mind. With persistence and discipline, you can grow your fund to be a reliable safety net for life’s twists and turns.

3 minutes read

3 minutes read

Banking

Posted: April 15, 2024

The digital age has brought us many things: social media, e-books and streaming services. It’s also changed the way we live our lives, from online shopping to food delivery apps, GPS directions to virtual meetings.

One of the most significant—and convenient—innovations of our time is online banking. Online banking has evolved from checking your balance online to connecting bank accounts, whether they’re at the same bank, different banks or third-party apps. The goal of connecting your accounts is to make it easier for you to manage your money, but many people still have questions about the security of linking accounts.

Linking accounts at the same bank

It’s not uncommon to have multiple accounts at the same bank, e.g. checking and savings. It’s simple to link these accounts on your bank’s website or app and makes it easy to transfer funds from one account to another. Some banks also provide incentives for people who link these accounts, like waiving monthly maintenance fees or overdraft fees.

Linking accounts at different banks

Some people maintain financial accounts at different banks; for example, they may keep their checking at one bank and their mortgage at another. It is possible—and perfectly safe—to keep accounts at separate banks but link them so you can easily move money between them. Many banking sites allow users to check information for both accounts in one place, but may have processes in place regarding how transfers can be made.

Linking accounts to third-party apps

Third-party finance apps like Venmo, Zelle, Cash App, PayPal and PocketGuard offer consumers alternate ways to manage their money, whether it’s to transfer money or track and manage spending. Though these apps are secure and safe to use, they do access sensitive information like bank account and credit card numbers. They don’t have the same kind of secure backing found at banks, but some are protected by the Electronic Fund Transfer Act, which protects consumers against unauthorized transactions.

Before you connect a third-party app to your bank accounts and credit cards, do your homework. Make sure the app is reputable and offers protection against unauthorized transactions.

How to link accounts

Linking accounts at the same bank is typically done automatically and simply requires a single sign-in to your bank’s website. Linking external bank accounts requires additional information and may vary by financial institution. In general, it’s smart to follow these steps:

- Gather relevant information, like account numbers, routing numbers and logins.

- Log in to your bank’s website or app and find the option to link or add an external account. The option may be on the dashboard or in settings.

- Select or type in the bank or financial institution you want to link.

- You might need to log in to the other bank you’re linking.

- Complete the verification process, usually sending a small deposit to confirm the accounts are linked.

The safety question

So, is linking bank accounts secure? Banks and credit unions utilize a variety of features to ensure safety, including:

- Transport layer security encrypts data, preventing hackers and cybercriminals from accessing your personal and account information.

- Tokenization involves exchanging data by converting it into tokens, which hide private information.

- Multi-factor authorization requires users to verify their identity using a numerical code sent to via text or email, PIN, fingerprint, or facial recognition.

Even with these safeguards in place, it’s important to take precautions when it comes to sensitive information. Keep passwords and PINs private, use two-factor authentication whenever possible, and research third-party finance apps before linking your accounts.

Still have questions? Contact us for more information.

3 minutes read

3 minutes read

Finance

Posted: April 9, 2024

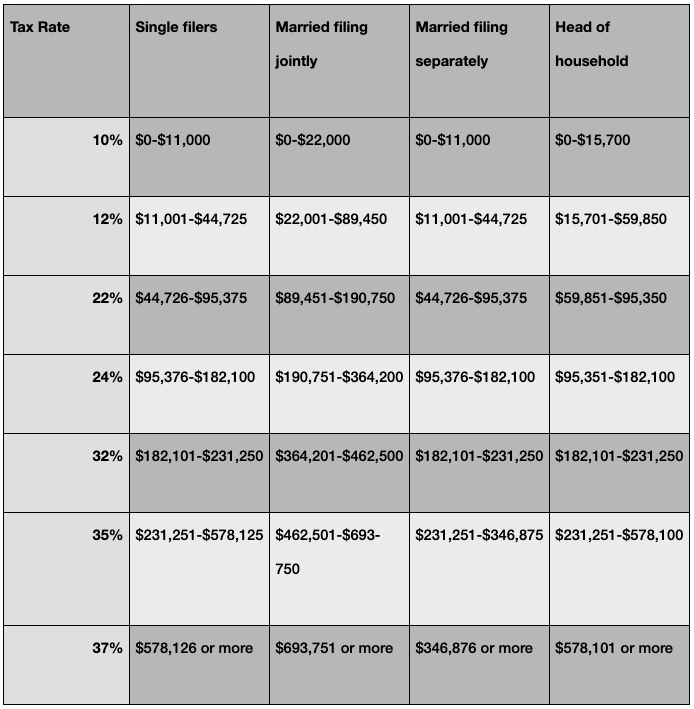

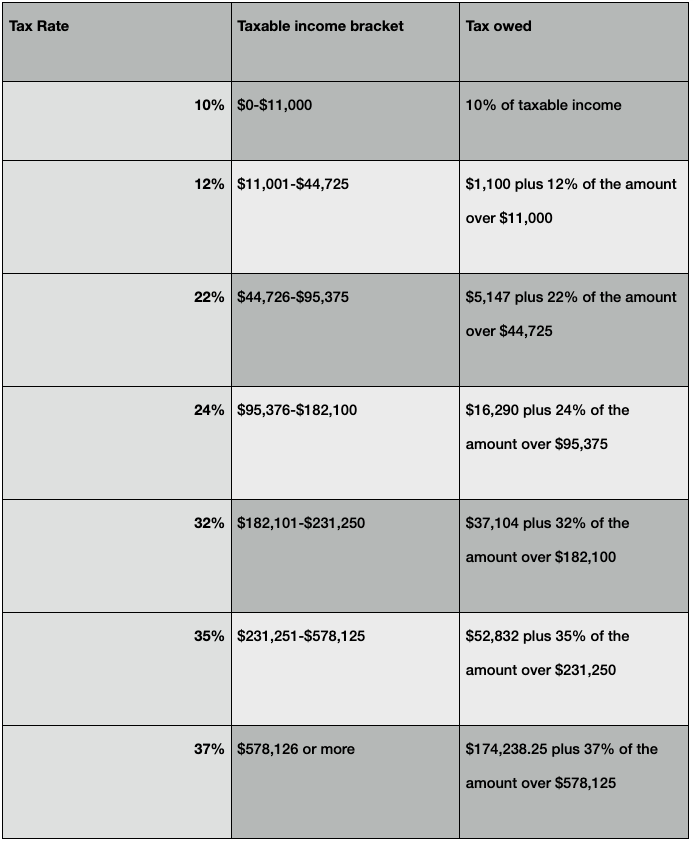

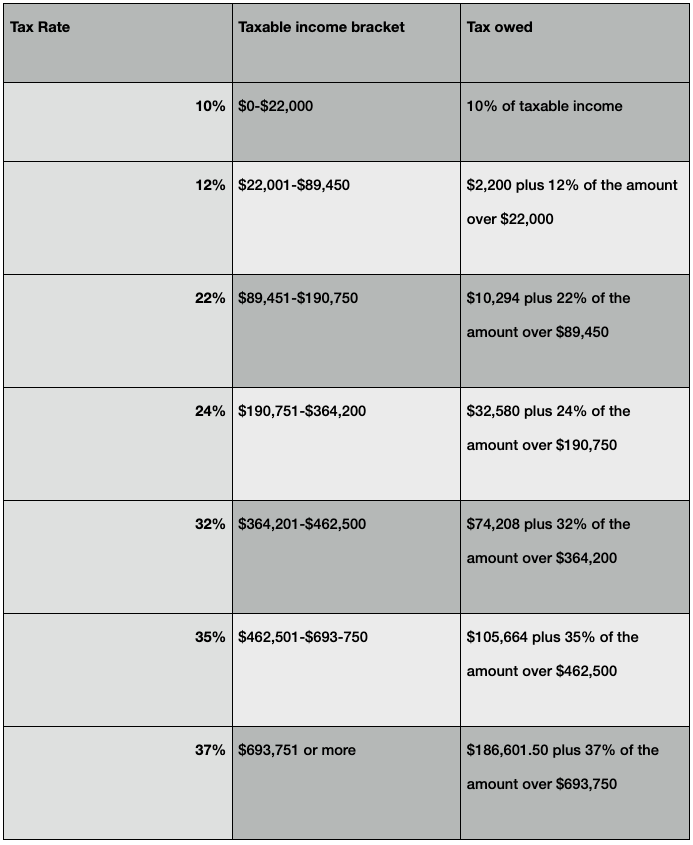

As tax day approaches, it’s important to understand the different tax brackets and what that means for you. Your tax rate is determined by your taxable income and filing status, which will drop you into one of seven tax brackets for 2023. Each bracket is assigned a corresponding tax rate; the highest rate, called a marginal rate, only applies to a portion of your income (more on that later). This system means that people with higher incomes pay higher federal taxes, and vice versa.

Federal rates will remain the same until 2025, thanks to the Tax Cuts and Jobs Act of 2017; however, the IRS may adjust thresholds for inflation.

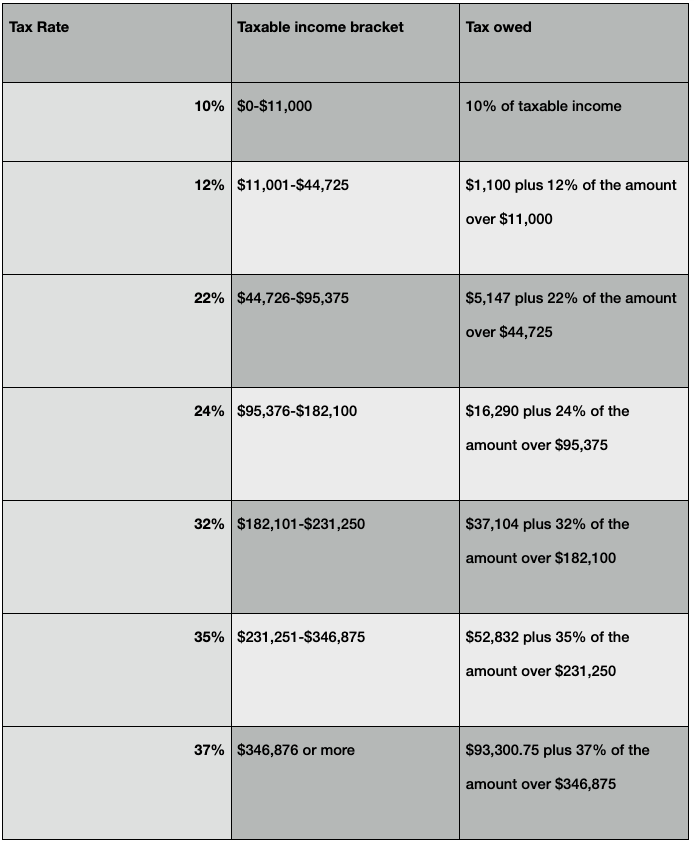

2023 Tax Brackets

There are four main filing statuses when it comes to taxes:

- Single filers

- Married filing jointly

- Married filing separately

- Head of household

Your income based on these filing statuses will determine your overall tax rate for the year.

For example, a single filer who made $50,000 in 2023 is in the 22% tax bracket. However, to complicate (but improve!) matters, this person won’t pay 22% on their entire income. Instead, their tax breakdown will look like this:

- $0-$11,000 of their income is taxed at 10% (approx. $1,100)

- $11,001-$44,725 of their income is taxed at 12% (approx. $4,047)

- $44,726-$50,000 of their income - only $5,274 - is taxed at 22% (approx. $1,160; this is the marginal rate)

That adds up to a tax bill of $6,300 ($5,147 plus 22% of the amount over $44,725), or 13% of this person’s taxable income - even though they are technically in the 22% bracket.

So, what is that 13%? The 13% is called an effective tax rate, which is the percentage of taxable income that you actually pay in taxes. To calculate this more easily, divide your total tax owed (line 16) by your total taxable income (line 15) on your Form 1040. The charts below can help give you an idea of what you owe.

Single filers

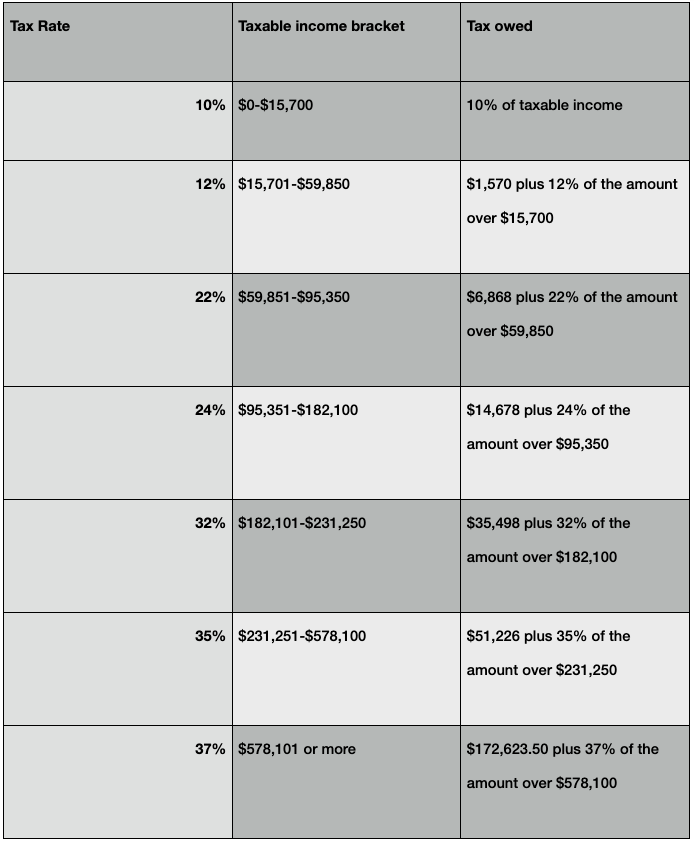

Married filing jointly

Married filing separately

Head of household

Reducing taxes owed

Finally, there are two ways to reduce your tax bill: credits and reductions. Credits reduce your bill on a dollar-for dollar basis and don’t affect your tax bracket. Deductions reduce how much of your income is subject to taxes. Check out our Delving into Tax Deductions blog for more info!

5 minutes read

5 minutes read

Finance

Welcome to the world of financial literacy, where the right information can transform your relationship with money and set you on the path to success. In this blog post, we will be reviewing five of Amazon’s top-selling finance books, because whether you’re a seasoned investor or a financial newbie, you can always learn something new. These books’ invaluable insights are reader-approved to help you reshape the way you think about and manage your money.

- The Simple Path to Wealth by J.L. Collins

Author and financial expert J.L. Collins provides a straightforward and practical approach to achieving financial independence in The Simple Path to Wealth. The book emphasizes the power of long-term investing in low-cost index funds and addresses common pitfalls, such as debt, that can hinder financial success. Collins’ conversational style and relatable anecdotes make complex financial concepts accessible to readers of all levels of financial expertise.

- I Will Teach You to Be Rich by Ramit Sethi

In this comprehensive guide that covers everything from budgeting to investing, Ramit Sethi combines financial advice with a touch of humor, making it an engaging read. The book focuses not only on building wealth, but also encourages readers to define—and then design—a rich life for themselves by aligning their spending with their values. Practical and action-oriented, this book is an excellent resource for those looking to take control of their finances.

- The Millionaire Next Door by Thomas J. Stanley and William D. Danko

More than four million copies have been sold since this book was published in 1996. Although the societal landscape looks very different today than when the book came out, the fundamentals behind Stanley and Danko’s research into how ordinary citizens become millionaires remain true. The authors’ deep dive into the habits and mindsets of the “next-door millionaire” reveals that living frugally while prioritizing saving and investing are behaviors that contribute to long-term financial success.

- The Psychology of Money by Morgan Housel

When it comes to money, what you know isn’t as important as how you behave, argues Morgan Housel. Attitudes shaped by experience and societal expectations can play a key role, as Housel shows in this exploration of the different—and often irrational—ways that people deal with financial matters. Anchored by 19 short stories, The Psychology of Money provides a look at the strange outcomes that can result when thoughts and feelings collide with logic, belying the school of thought that finance is purely a numbers game.

- The Intelligent Investor by Benjamin Graham

Regarded as a classic in the world of investing since it was first published in 1949, The Intelligent Investor remains widely acclaimed for its timeless principles for wise investing. Benjamin Graham’s insights, adapted for modern investors by financial columnist Jason Zweig, emphasize the importance of a disciplined approach to investing.

Remember that financial education is an ongoing journey. Each of these books adds a unique perspective to your personal finance bookshelf; together, they form a wide-ranging collection to guide you on the way toward achieving financial well-being. Visit your local WaterStone Bank branch to speak with a banker and find out how we can assist you on your financial journey.

4 minutes read

4 minutes read

Finance

From essays to applications, there is a lot that goes into preparing for college. Chief among them is the Free Application for Federal Student Aid, or FAFSA, form. It’s smart to complete the FAFSA form as soon as it’s available, because federal funding is limited.

What is FAFSA?

FAFSA is an application for federal student aid, including federal grants, work-study programs, and loans, for prospective and current students. Some states, colleges, universities, and private lenders also use information from FAFSA to determine students’ eligibility for financial aid. You must complete the FAFSA form for each year you plan to apply for federal aid.

Information reported on the FAFSA form is used to calculate the student’s Expected Family Contribution (EFC). This measures a family's financial capacity, determines how much federal aid a student is eligible for, and may be used by your state and schools to determine grant and scholarship eligibility.

When do I need to fill out FAFSA?

FAFSA for the next academic year becomes available on October 1. So, if your student is a rising senior and plans on attending college beginning with the 2025 fall semester, FAFSA will become available on October 1, 2024.

Many colleges have different FAFSA deadlines, so be sure to check each school’s financial aid office. If you’re not sure which schools you’re applying to, that’s OK—just list the ones you’re interested in. Different states also have different deadlines.

Officially, the U.S. Department of Education’s federal deadline to complete FAFSA is June 30; however, the sooner you submit your form, the better. Aim for December at the very latest.

Who should fill out FAFSA?

According to studentaid.gov, “The Free Application for Federal Student Aid (FAFSA) form is the student’s responsibility, but when a student is considered a dependent student for FAFSA purposes, parents have a large role in the application process.”

When filling out the form, it is important to identify who the student’s primary parent(s) are.

- Parents married to each other: report information for both parents on FAFSA.

- Parents who are unmarried but live together: report information for both parents on FAFSA, even if they were never married, are divorced or are separated.

- Parents who are unmarried and do not live together: if a student lived with one parent more than the other for the last 12 months, they should report that parent’s information on FAFSA. If they spent an equal amount of time living with each parent, they should report the information of the parent who provided more financial support over the last 12 months. If the reporting parent has remarried, also report information for the stepparent on the FAFSA form.

Per studentaid.gov, it is important to note that “dependent students are required to report parent information when completing the FAFSA form.” This includes biological and adoptive parents and legal guardians. Stepparents are considered parents if they are married to a biological or adoptive parent and if the student counts in their household size.

Students who were not dependents of their parent(s) or legal guardian(s) for the last 12 months should fill out the FAFSA form with their own information.

What do I need in order to complete FAFSA?

Parents and children should gather the following materials prior to completing the form:

- Social Security number, or Alien Registration number for non-U.S. citizens who are eligible noncitizens.

- Federal income tax returns, W-2s and other records of money earned.

- Bank statements and records of investments, if applicable.

- Records of untaxed income, if applicable.

To get started, one parent and the student must both create FSA ID usernames and passwords, which they will use to sign in. Students must also create a save key, a temporary password that enables them to return to partially completed FAFSA forms.

How do I complete FAFSA?

There are three options when it comes to filling out the FAFSA form:

- Log in at fafsa.gov to complete the form online.

- Complete the FAFSA PDF for the award year you’re applying for. In this case, you must print and mail the FAFSA PDF for processing.

- In some cases, schools may submit the FAFSA form for students.

Technically, the form is the student’s application, so where it says “you” on the form, it means the student.

You may use the IRS Data Retrieval Tool (IRS DRT) to transfer your federal tax return information into the FAFSA form. Once you submit your form, you will see a confirmation page and may also see a link to your state’s financial aid application. You may be able to transfer your federal information into the state application. Parents who have more than one child attending college can transfer their information to their other child/children’s FAFSA form(s).

What happens next?

You will receive a confirmation email that your FAFSA form has been submitted, processed, and sent to schools. You may check your application status online or by phone at 1-800-4-FED-AID.

After your application is processed, the student will receive a Student Aid Report. It is important to review this to ensure your information is correct and complete. Students typically receive federal, state and scholarship aid offers from schools in the winter and spring. studentaid.gov has great resources for understanding and comparing aid offers and what they mean for financing education.

Still need help? Visit Federal Student Aid for more information, tips and frequently asked questions.

5 minutes read

5 minutes read

Finance

One goal that resonates with many Americans is becoming wealthy, although that means different things to different people—for some, it’s comfort and security, for others lottery-winner-level luxury. Get-rich-quick scenarios aside, for most of us, the key to making that wish for wealth a reality is disciplined saving and investing. In Part I of our Smart Money Goals post, the emphasis was on fundamental approaches to setting yourself up for future financial success. Now in Part II we delve into five tactics to help grow your affluence over time.

- Automate your savings

Accumulating savings is a precursor to investing. To ensure consistent contributions to your wealth-building journey, automate your savings. Through your employer or your bank, arrange automatic transfers of a portion of every paycheck into separate savings or retirement accounts. If your employer offers a 401(k) or similar plan, have your contribution automatically withdrawn from your paycheck and deposited into your account. Financial advisers recommend contributing at least enough to maximize your employer’s matching contribution in retirement plans.

- Reminder to rebalance

Out of sight is not out of mind. Even though your deposits are set up to operate without much input, it’s important to periodically revisit your accounts and adjust them as necessary. Schedule a quarterly, semi-annual or annual fine-tuning session.

- Bump up the savings rate

From time to time, boost your savings percentage, especially when you receive a raise or a bonus. These small increases can pay off over the long term. Take advantage of money market accounts that earn interest. If you won’t need access to your money for several months, CDs can be a good option.

- Invest for growth

While savings accounts offer security, inflation may outpace any interest you earn. For a greater payoff, you can put your capital to work with investments—a good place to start is with the basics: stocks, bonds and mutual funds. Since all types of investments perform differently, and investing carries inherent risk, spreading your capital around into diverse types of investments can be a sound tactic. Attempting to predict what’s going to happen with the stock market is risky. A safer approach is practicing discipline by staying invested in a diversified portfolio, even during downturns.

- Watch out for the fees

Different investments include different kinds of costs—expense ratios, custodian and maintenance fees, and loads and commissions are just a few. It’s worth educating yourself about what types of costs are associated with your investments, and to recognize that these costs that start out as a small percentage can add up fast, especially as your investment grows in value. Choosing lower cost purchases will soften the sticker shock.

Building wealth is a long-term goal: Earning interest and making wise investments puts your money to work for you behind the scenes, while you go on about your life. Strategic financial habits will help you pave the way and weather setbacks on your way to achieving financial success. Visit your local WaterStone Bank branch to speak with a banker and learn how you can start taking steps to building wealth.

3 minutes read

3 minutes read

Finance

The journey to financial well-being begins with setting clear, attainable goals. These objectives will not only provide a roadmap for financial success but are also the building blocks for future stability. This two-part post covering short- and long-term financial goals begins with five actions that will set you up for financial success in the new year and beyond.

- Emergency Fund: Build or Replenish

Establishing or replacing an emergency fund is a crucial short-term goal. Aim to save enough to cover three to six months’ worth of living expenses. Consider housing, utilities, transportation, insurance and medical costs, among others. This fund serves as a safety net for unexpected expenses or sudden changes in your circumstances.

- Pay Off High-Interest Debt

Prioritize paying off credit card balances or personal loans. Reducing or eliminating debt not only improves your financial health but also frees up money that can be redirected towards other goals.

- Create a Monthly Budget

Develop a detailed monthly budget that accounts for all your income and expenses. Consider fixed expenses such as rent or mortgage payments, as well as variable expenses, such as grocery and food costs.

- Save for a Specific Purchase

Identify a short-term objective to save for, such as a vacation or a new electronic device. Working toward and achieving smaller goals can prove a sense of accomplishment and help you practice disciplined financial habits that lay the groundwork for greater aspirations, such as purchasing a house.

- Establish a Retirement Savings Habit

If you haven’t already, start contributing to a retirement savings accounts, such as a 401(k) or an Individual Retirement Account (IRA). While retirement is a long-term goal, initiating the habit of regular contributions is a crucial short-term step toward securing your financial future.

Remember that the key to achieving goals is setting realistic targets and tracking your progress, recalibrating as needed. For setting long-term financial goals, check out Smart Money Goals Part II.

2 minutes read

2 minutes read

Finance

Ready or not, April 15 is coming! Whether you work with an accountant or do your taxes yourself, understanding the ins and outs can be a minefield.

Understanding tax deductions

One component of doing taxes that can be particularly confusing is the concept of tax deductions. A tax deduction is an expense that you can subtract from your income, reducing the amount you pay in taxes. Tax deductions lower your taxable income, helping you save money.

Charitable donations are the most common types of tax deductions as they reduce your taxable income by subtracting the amount of money you donated to charity. For example, if your annual income is $75,000 and you donate $3,000 to charity, you will be only taxed on $72,000.

Understanding tax credits

While tax deductions lower your taxable income, tax credits reduce the amount of tax you owe and cut your taxes dollar for dollar. Think about it this way—if you make $100,000 a year and have a tax deduction of $10,000, your taxable income is $90,000. If your tax rate is 25%, that’s a tax bill of $22,500.

Now, let’s say your income is still $100,000 a year, you don’t have any deductions, and your tax rate is 25%. That puts your calculated taxes at $25,000. However, you have a tax credit of $10,000, bringing your actual tax bill down to $15,000.

Tax credits can be either refundable or nonrefundable:

- Nonrefundable: If you don’t owe much in taxes, it’s possible that you won’t be able to receive the full value of your credit. For example, a $500 tax bill and $1,000 credit won’t get you a $500 refund check—it just means you’ll owe $0 in taxes.

- Refundable: Refundable tax credits include the earned income tax credit and the child tax credit. In these cases, if the value of your credit exceeds the amount you owe in taxes, you will receive a refund check.

Standard vs. itemized deductions

You have two options when it comes to tax deductions: standard deductions and itemized deductions.

- Standard deductions: The IRS sets the standard deduction each year, and it’s the easiest option, especially if you’re doing your taxes yourself. If you choose to go this route, your taxable income is automatically reduced by a set amount based on how you file (single, married filing jointly, etc.).

- Itemized deductions: With itemized deductions, you need to list each one of your deductions you’d like to claim ($50 to charity A, $100 to charity B, etc.). Itemizing can be a pain, but it’s worth it if you have enough deductions that will lower your taxable income more than the standard deduction.

Choosing the best option for you

How do you know whether a standard or itemized deduction is best for you? Standard deductions for 2023 are:

- Single: $13,850

- Married filing jointly: $27,700

- Married filing separately: $13,850

- Head of household: $20,800

Charitable donations aren’t the only things that are tax deductible. Other write-offs include:

- Medical expenses: expenses that are more than 7.5% of your taxable income and weren’t covered by insurance

- State and local taxes: the IRS allows people to choose whether or not they deduct state and local sales and income tax

- Student loan interest: even if you don’t itemize, you can write off interest paid on student loans

- Mortgage interest: you may deduct the interest you paid on up to $750,000 of mortgage debt

- Retirement and investing: traditional IRA contributions are tax-deductible, but your deduction might be limited

- Home office deduction: work-from-homers who set up a workspace used only for business can write off work-related expenses, including rent, utilities, and maintenance

The bottom line

So, which deduction is right for you? Most people take the standard deduction, but it can pay off—literally—to add up your itemized deductions before you make the final call. Would you save more by itemizing? Is the effort worth the time and payout, or is it easier for you to take the standard deduction and call it a day?

There’s no one-size-fits-all answer; it all depends on how complex your taxes are in a particular year. When in doubt, consult a tax expert who can point you in the right direction and help you better understand your individual tax situation.

3 minutes read

3 minutes read

Finance

For many people, December is a time of reflection to look back on the past year and make plans for the new year ahead. Many people also resolve to make positive changes in their lives. In this spirit, the end of the year is the perfect time to take a look at a year’s worth of finances and make adjustments and plans for next year. (It also gives you a head start on tax season, which will be here before you know it!)

We’ve rounded up some top tips to help you check all the boxes on your end-of-year financial checklist.

Analyze your spending

How much money did you spend in 2023? Take a close look at all your accounts, expenses and bills to get a clear picture of how you allocated your spending. Did you take a bucket list vacation, funnel money into a college savings account, tackle a home improvement project, or just go out to eat a couple of times a week?

Also, consider any big life changes like marriage, divorce, a new baby, etc. Major life events can have a huge impact on your financial plan.

Once you have a solid understanding of your 2023 finances, see where you can adjust for 2024. That could mean spending less in certain areas of your life, increasing your regular contributions to a retirement account, or saving for a big purchase, like a new car.

Examine employee benefits

For most companies, benefits open enrollment falls toward the end of the year. This is a great time to review your current benefits, particularly retirement savings. For 2023, the maximum 401(k) contribution was $22,500, plus an additional $7,500 if you’re over 50. The maximum IRA contribution was $6,500, plus $1,000 if you’re 50+.

How did you stack up this year? Did you max out your contributions? Are you at least contributing as much as the employee match? If you can afford to, try to increase your monthly contribution next year. Also, look at allocations; are you satisfied with the ratio of stocks and bonds?

Many employee benefit plans also offer health savings accounts (HSA) and flexible spending accounts (FSA). Did you put any money into these accounts? How much of that money did you use, and what did you use it for? Remember: HSA contributions do not expire, but money in FSAs must be used by the end of the year.

Finally, now is a good time to update your beneficiaries and ensure your money ends up with the people you choose.

Prepare for tax day

April 15 will be here before you know it. Get ahead of the game by identifying any life events like marriage, divorce, births, deaths, and retirement that could affect your withholding status. An accountant can help you review any taxable transactions, deductible expenses, charitable gifts and more that might impact your taxes.

Review investments

Investing is a long game, but it never hurts to look at your allocations and determine if you’re getting the most bang for your buck. Are certain assets under- or over-performing? Are you comfortable with riskier investments, or are you ready for a more steady, conservative approach? Keep in mind that capital gains and investment losses can make a big impact on your taxes. When in doubt, speak to an investment professional who can help steer you in the right direction.

Assess charitable contributions

Charitable contributions aren’t just a nice gesture—they’re also tax deductible. Did you maximize your charitable contributions in 2023? Did you donate any assets, like a pre-owned vehicle? To learn more about charitable contributions and how they impact your taxes, speak with an accountant or tax advisor.

Manage debt

Debt is part of life, but it’s how you manage it that matters. Are you carrying any credit card debt? Student loans? Auto loans? The end of the year is the perfect time to take a close look at your debt, interest rates, loan positions and more. Have you made any progress paying things down (or, even better, off)? Are you able to consolidate any loans or negotiate for lower interest rates in 2024?

The key is to balance your financial goals, and that includes paying down debt.

Consider estate planning

Wills, trusts, and estate planning aren’t always the most comfortable topics of discussion, but that doesn’t mean they’re any less important. The end of the year is a good time to review these types of planning documents, particularly for beneficiaries and trustee designations. You may want to name a corporate trustee or co-trustee who can remain objective when administering a trust.

Ensure you’re insured

Last but not least, examine your insurance policies and coverage. Are you getting the most out of your policies? Are they still worthwhile? Is your coverage sufficient for your needs? As with estate planning, this is a good time to make sure your beneficiaries are up to date.

Still have questions about year-end financial planning? Contact WaterStone Bank for more information.

4 minutes read

4 minutes read

Finance

The holiday shopping season has arrived, and with it an enticing array of discounts, sales, and specials. Everybody loves a good deal, but how can you be sure you’re getting the most bang for your buck? And how can you ensure you’re not falling victim to some retail mind control? We’ve rounded up some of the most common strategies that retailers use to bring in the big bucks at your expense.

Price Anchoring

Price anchoring is a psychological strategy that involves comparing two similar items, one at a high price and one at a lower price. The higher-priced option is used as an anchor to make the lower-priced product seem more attractive. You see this a lot in infomercials: “This product is normally $250, but if you order in the next 30 minutes, it’s yours for $50!” Avoid price anchoring by shopping around, comparing product prices and reading reviews.

Price Cushioning

Let’s say you’re shopping for sneakers, and you see one pair for $50, and another for $20. Most shoppers will opt for the more expensive pair, as they perceive them as being of higher quality. But if you throw a third pair of shoes into the mix at $35, suddenly that option seems much more appealing! It all comes down to how the options were presented to them. Avoid falling for price cushioning by figuring out exactly what you want and saving for it.

Buy One, Get One

BOGO offers seem like a great deal—after all, you're getting something for a much lower price, if not for free! But really, they’re just a trick of the trade to get consumers to buy two things, when they really only need one. Stores use this strategy to spend more money than you originally planned.

Coupons

Coupons can be tricky. Many times, store-brand items are cheaper than name-brand products—even with a coupon for the name-brand item. Other times, coupons come with a long list of restrictions. Or, what may seem like a great incentive (earn a $10 coupon for a certain amount spent) is just a tactic to get you to spend more at a later date.

Eye-Level Options

Why does it always seem like the best products are right at eye level? Because they are. Stores carefully position items so that the most enticing are at eye level, exactly where you’ll see them. Lower-priced and sale items are positioned below eye level or at the back of the store and are generally more difficult to find. Try to avoid “shiny object syndrome” and hunt for the good deals.

Sensory Appeal

Things like music to listen to, perfumes to smell, food samples to taste, etc. all enhance the senses and create a sense of urgency and desire. This sensory appeal helps people connect with individual products and encourages them to spend more.

Store Layouts

Have you ever noticed that when you walk into a store, there aren’t displays until you get about five steps in? That's because, psychologically, when people walk into a store, they’re trying to orient themselves. They don’t notice products right by the door because their focus is on where to go next. People also tend to move to the right first, which has caused many stores to create strategic layouts and navigational blockers that encourage shoppers to spend more. (Grocery stores and a certain Swedish home goods retailer have this down to a science!) Finally, people often perceive products placed on endcaps to be better deals, but that’s not always the truth. More often, they’re name-brand impulse buys.

Vanity Sizing

Anyone who has gone clothes shopping recently understands that sizing is drastically different from one store to another. You may fit into size 8 jeans at one store, and size 12 at another. This is called vanity sizing. Stores give customers a little ego boost by monkeying around with their sizes so that people keep coming back. There’s no easy way to avoid vanity sizing; instead, try on a variety of sizes at each store and buy what fits. The number is arbitrary!

Point-of-Purchase Displays

Point-of-purchase products are typically displayed throughout the line as you wait for your turn to check out. They’re those bright, shiny objects that you don’t need, but just can’t resist when you see them. Most stores have these, whether they’re last-minute snacks, new nail polish colors, seasonal items, etc.

Credit Card Offers

Many stores offer an immediate discount if you apply for their credit card. But what they don’t mention is the high interest rates that will negate your immediate savings, and how easy it is to rack up a balance. And don’t think that you can get off scot-free by applying for the card and canceling it later. That can actually do long-term damage to your credit score.

Free Shipping

How many times have you gone to check out while online shopping, only to find out that if you spend just $2 more, you’ll qualify for free shipping? Except that you can't find anything on the site that costs less than $10, which is more than the cost of shipping. Now, you could purchase those extra items and return them later, but is it worth it? And will you remember to do so? The retailer is willing to bet you won’t.

Limited Time Only

A sense of urgency and exclusivity encourages consumers to make impulse purchases while they can. After all, what if that cute sweater sells out? Another tactic online retailers use is a “1 item left” tag. This threat encourages you to purchase the item before someone gets to it before you. But in reality, there's no way to know for sure that it’s the only one left.

The age-old phrase is true: If something seems too good to be true, it probably is. Do your research, compare products and understand that some of these “deals” might just be a retailer trying to take you for a ride.

For more financial tips and tricks to save your hard-earned money, check out the WaterStone Bank blog.

5 minutes read

5 minutes read

Banking

The holidays are here, and with them come tighter belts and tighter budgets. But that doesn’t mean you can’t eat like kings and queens this Thanksgiving! We’ve rounded up our top tips for festive feasting to ensure your day of thanks is delicious without breaking the bank.

Set a budget

Take a look at your food budget and decide what you can realistically afford to spend on your Thanksgiving meal. Where can you cut corners? Are there any foods that people barely touch that you can leave off this year’s menu? These days, many grocery stores have websites with prices listed; do your homework and stick to your list.

Research recipes

Every Thanksgiving table has the standards: turkey, mashed potatoes, stuffing and more. Before you head to the store to stock up, take a close look at your recipes and which ingredients you already have in your pantry. Do you need more cinnamon, or is there a jar hiding in the back of the pantry? Avoiding superfluous spending will help you stay on budget.

Make a list

We’ve all done it: We go to the grocery store without a list, thinking that we know exactly what we need. And how many times have you walked out without a key item, or added extra items to your cart? It’s easy to do! This Thanksgiving, make a list and stick to it.

Shop in season

When planning this year’s Thanksgiving menu, consider in-season, and therefore affordable, fruits and vegetables like apples, cranberries, squash, pumpkin, broccoli and more. Many of these are already Thanksgiving classics, so it’s a win-win!

Stock up where you can

To avoid dropping a chunk of change at one time, stock up where you can. Buy non-perishable items like wine, napkins and canned goods when they’re on sale, and remember that some perishable items, like potatoes, have longer shelf lives than others. Spreading out your spending makes Thanksgiving shopping easier to digest.

Decrease decor

These days, it’s easy to look at social media and think you need to go overboard with your decor, but it’s just not true. Thanksgiving is all about sharing a meal with the ones you love and being thankful for what you have—not trying to prove yourself for faceless followers on social media. Save money this year by repurposing existing decor, doing DIY projects with the kids, or bringing in touches from the outside like pumpkins and flowers from the garden.

Embrace potluck style

It’s usually easiest for the Thanksgiving host to cook the turkey, but that doesn’t mean they should be responsible for all of the sides. Save money this year by making Thanksgiving a potluck event and assigning sides and desserts to your guests. Not only does it save money, but it’s also a great way to try new dishes and flavors!

Love the leftovers

A big meal like Thanksgiving usually results in a lot of leftovers. Reduce food waste by sending leftovers home with guests, creating a casserole with your favorite dishes, adding fruits to muffins and oatmeal, and so on. The possibilities are endless, and there are countless recipes online to help you craft a delicious Thanksgiving leftover recipe that just might become a yearly mainstay.

During this season of gratitude, we’re thankful for customers like you. Wishing you a Thanksgiving filled with happiness and cherished moments with your loved ones!

3 minutes read

3 minutes read

Finance

Temperatures are dropping, leaves are falling and everybody’s favorite autumn beverage—pumpkin spice—is back. As we begin to spend more time indoors, it’s a great time to think about renovations and home improvement projects to take on during the colder months.

Getting started

So, where to start? First, think about the scope of your project and what you’re trying to accomplish. Are you planning on cosmetic updates, like a fresh coat of paint and some new cozy blankets and throw pillows? Or do you want to install a gas fireplace, replace your kitchen cabinets or finish your basement?

Funding your project

If your renovation project is on the larger side, chances are you may want to leverage your home’s equity to fund it. Your home’s equity consists of the portion of your home that you own outright, whether that was paid in cash or via a mortgage. If you have paid off a significant portion of your home, you can use that equity to fund renovations—basically, using your home’s worth to increase its worth. One way to fund your project is through a home equity line of credit, or HELOC.

HELOCs are lines of credit that can have fixed or variable interest rates. You may access funds and make interest payments for a specific period of time (usually around 10 years); after that period of time ends, a repayment period begins, during which you may no longer access the funds.

Pros and cons of HELOCs

Pros:

- The freedom to use as much or as little money as you need, whenever you need it

- You are only obligated to repay the amount of credit you have used and pay interest on the amount you’ve withdrawn

- Ideal if you’re not sure how much time and money you’ll actually need to complete your renovation project

Cons:

- Interest rates may fluctuate, which means your monthly payments may increase

- You can borrow from a HELOC multiple times and don’t need to start paying back the principal right away, so it can be easy to accrue a balance

- Potential annual fees

- HELOCs factor into your credit report

Factors to consider

Before opting for a HELOC, it’s important to consider whether or not your home improvement project increases your property value and if you’ll see a return on your investment. This can be quantitative or qualitative. Quantitatively, a $25,000 kitchen remodel doesn’t necessarily mean your home’s value will increase by $25,000. However, qualitatively, a remodel may make your everyday life easier and add personal value.

It’s also important to consider your project budget, how much you can realistically afford to borrow, and how long it will take to repay it. If HGTV has taught us anything, it’s that renovations usually take longer and cost more than you anticipate.

Applying for home equity funding

The WaterStone Bank home equity line of credit has no minimum requirements on transactions, allowing you to spend what you need, when you need it. Easier access to your funds means greater financial control, coupled with flexible payment options.

Apply for a HELOC today!

4 minutes read

4 minutes read

Security

In this day and age, it’s virtually impossible to escape the internet. We live in a digital world, and as great as it can be—information at your fingertips, ease of use, funny cat videos—it also has a dark underbelly. Over the years, scammers have grown more sophisticated and found new ways to access personal information you’d rather keep private. How in tune are you with common information theft scams, and do you know how to avoid them?

Spoofing and phishing

Spoofing and phishing are probably the most common scams—and the easiest to avoid. Email scammers try to catch your eye with an attention-grabbing subject line, whether it’s a problem with your bank account or a can’t-miss sale at your favorite store. When you click a link or open an attachment, the scammer installs malware on your device that can infiltrate your files and steal information like bank account numbers, website passwords and more.

Common email scams include:

- Scams that imitate a person or business you’re familiar with

- An urgent, don’t-miss-it offer

- An “official notice” that encourages you to take action

- Lottery win

- Fake survey

Phone scammers call claiming to be from a legitimate business and ask you to take action. They may request an additional payment so that an essential service, like your power, remains on. Or, they may call and ask you to verify a code that was sent to you via text message from a legitimate business.

How to protect yourself from falling victim to spoofing and phishing:

- Examine each email carefully. Do you recognize the sender, or is there something off about their name or email address? Look for things like a zero instead of an O, or an unusual number of misspelled words.

- Hover over links and images without clicking to see what shows up; does it look like a legitimate website, or does it have a string of characters that make no sense?

- If anything looks strange, err on the side of caution. Contact the supposed sender/caller directly to verify whether or not the email or call is legitimate.

- Most businesses will not call and request codes sent via text message. Anyone who calls should be considered suspicious.

Elder fraud

Elderly people are still the most likely to fall victim to scams. Take, for example, a woman who receives an email from her grandson, who is studying abroad and asks her to wire him money. On the surface, the facts check out; however, it’s possible that the grandson’s email account was hacked and that the email is a scam.

How to protect yourself from elder fraud:

- Double-check everything before taking action. Contact the individual or business that appears to have sent you the email or made the phone call to verify that it was them.